Link Intime IPO Allotment: A Comprehensive Guide for Investors

The term “Link Intime IPO allotment” refers to the process of distributing shares of an Initial Public Offering (IPO) through Link Intime, a renowned registrar in India. Link Intime India Pvt Ltd is known for handling the allotment process for numerous IPOs. Understanding how Link Intime IPO allotment works is essential for any investor looking to gain shares in an IPO. The process involves allotting shares to investors who have applied, and it’s done based on regulations and oversubscription status.

When an IPO is launched, investors flock to buy shares, and Link Intime plays a critical role in managing this allocation. The company ensures transparency and fairness in the allotment process. In this article, we’ll guide you through various aspects of the Link Intime IPO allotment process, helping you make informed decisions.

How to Check Your Link Intime IPO Allotment Status

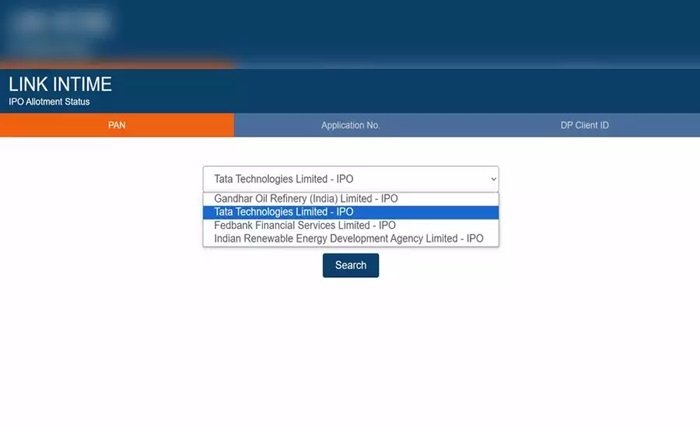

To check your Link Intime IPO allotment status, visit the official website of Link Intime and use their dedicated allotment portal. The portal requires essential information like your PAN number, application number, or DP client ID. Simply enter the details and follow the prompts to see your Link Intime IPO allotment status.

Investors are eager to check their Link Intime IPO allotment status as it helps them determine whether they have received the shares they applied for. The allotment status is usually updated a few days after the IPO closes. Keeping track of this information ensures that you can plan your next moves, whether you have been allotted shares or not.

Understanding the Link Intime IPO Allotment Process

The link intime process is systematic and transparent. Once the IPO subscription period ends, Link Intime starts the process of allotting shares to eligible applicants. The process takes into account various factors, including the demand for the IPO and the number of shares available.

In cases of oversubscription, the Link Intime IPO allotment process becomes more challenging, as not all applicants will receive shares. In such scenarios, shares are distributed through a lottery or proportionate basis. Understanding the Link Intime IPO allotment process can help investors set realistic expectations and prepare accordingly.

Why is Link Intime the Preferred Registrar for IPO Allotment?

Link Intime IPO allotment is trusted by many investors because of the company’s reliability and transparency. Link Intime India Pvt Ltd is a SEBI-registered registrar and has a strong track record in managing IPO allotments.

One reason for the popularity of Link Intime IPO allotment is its user-friendly online portal, which provides investors with easy access to information. The company follows strict regulations to ensure a fair allotment process. Investors rely on Link Intime for their IPO allotment needs because of their efficiency and commitment to maintaining market integrity.

Common Issues Faced During Link Intime IPO Allotment

While Link Intime IPO allotment is generally smooth, investors may sometimes face certain issues. One common problem is difficulty accessing the website due to heavy traffic when the allotment status is released. Investors looking to check their Link Intime IPO allotment status may experience delays during these high-demand periods.

Another issue involves incorrect information, such as entering the wrong PAN number or application ID. These errors can lead to difficulties in retrieving your Link Intime IPO allotment details. To avoid such issues, ensure that all information entered is accurate and up to date.

Link Intime IPO Allotment Timeline Explained

The Link Intime IPO allotment timeline is important for investors to understand. The process typically starts after the IPO subscription period ends and involves several key steps. First, the registrar, Link Intime, validates all applications to ensure they meet the required criteria.

The actual allotment process usually takes two to three working days, after which the Link Intime IPO allotment status is made available online. Once the shares are allotted, they are credited to the investors’ Demat accounts. Understanding the Link Intime IPO allotment timeline helps investors stay informed and prepared throughout the process.

How to Increase Your Chances in Link Intime IPO Allotment

Many investors want to increase their chances in the Link Intime IPO allotment process. One effective strategy is to apply through multiple Demat accounts, as it may increase the likelihood of being allotted shares, especially in highly oversubscribed IPOs. However, ensure that each account is in a different family member’s name to comply with SEBI regulations.

Another way to improve your chances in the Link Intime IPO allotment is by applying for the minimum lot size. In most cases, IPO allotments prioritize applicants who apply for the minimum number of shares. Following these strategies may enhance your odds of a successful Link Intime IPO allotment.

Key Features of Link Intime’s IPO Allotment Portal

The Link Intime IPO allotment portal is designed to be user-friendly and accessible to all investors. The portal allows you to check your allotment status using various credentials, such as your PAN number, application number, or client ID. The simplicity and effectiveness of the Link Intime IPO allotment portal make it a preferred choice for many investors.

Another key feature of the Link Intime IPO allotment portal is the transparency it provides. Investors can easily access information and track their application status. This level of transparency and ease of use makes Link Intime a trusted partner for IPO allotment in India.

What Happens After the Link Intime IPO Allotment?

After the Link Intime IPO allotment, investors receive their allotted shares in their Demat accounts. The next step involves waiting for the listing of the shares on the stock exchange. If you have received shares in the Link Intime IPO allotment, they will be credited to your account before the listing date.

For those who did not receive any shares in the Link Intime IPO allotment, the refund process begins soon after the allotment is finalized. The refund is typically processed within a few days, and the funds are credited back to the bank account linked with the IPO application. Understanding what happens after the Link Intime IPO allotment ensures that you are prepared for the next steps, whether it involves selling on listing day or waiting for the long term.

Conclusion

The Link Intime IPO allotment process is an essential part of investing in new market opportunities. Whether you are a seasoned investor or a beginner, understanding how the Link Intime IPO allotment works can help you navigate the process more effectively. By knowing how to check your allotment status, understanding the timeline, and using strategies to improve your chances, you can make the most out of your IPO investments.

Link Intime’s role as a trusted registrar makes it easier for investors to participate in IPOs with confidence. With a clear understanding of the Link Intime IPO allotment, investors can set realistic expectations and be better prepared for their investment journey.

FAQs

1. How do I check my Link Intime IPO allotment status?

You can check your Link Intime IPO allotment status by visiting the official Link Intime website and using their IPO allotment portal. You will need your PAN number, application number, or DP client ID to check the status.

2. What is the timeline for Link Intime IPO allotment?

The Link Intime IPO allotment process usually starts a few days after the IPO subscription period ends. The entire process, including share allotment and refunds, typically takes around one week.

3. Can I increase my chances in Link Intime IPO allotment?

Yes, you can increase your chances by applying through multiple Demat accounts under different family members’ names and applying for the minimum lot size.

4. What happens if I do not receive any shares in the Link Intime IPO allotment?

If you do not receive any shares, the refund process will begin soon after the allotment is finalized. The funds will be credited back to your linked bank account.

5. Why is Link Intime a preferred registrar for IPO allotment?

Link Intime is preferred for IPO allotment due to its reliability, transparency, and user-friendly portal that makes the entire allotment process smooth for investors.